TL; DR

- Galen Growth’s annual HealthTech 250 is a data-driven, no hype nor bias evaluation of early-stage digital health ventures across the globe. This list features 31 ventures that were founded in Asia-Pacific.

- As a region known for incubating strong ventures, 45% of APAC’s Digital Health ventures in Galen Growth’s HealthTech 250 have raised Series A funding.

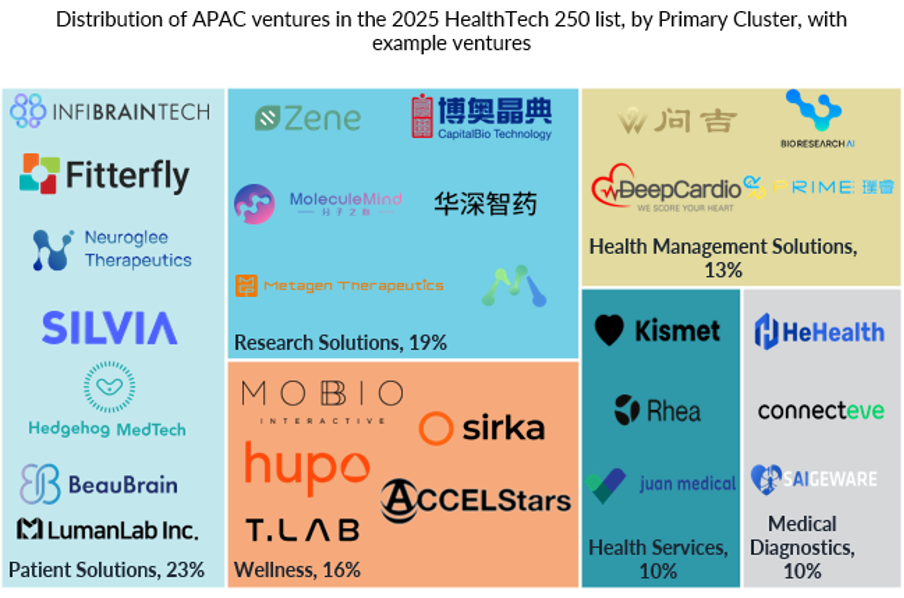

- Reflecting a broadening impact across various health challenges, 23% of ventures focus on Patient Solutions, 19% on Research Solutions, and 16% on Wellness.

- Increasing numbers of corporate partnerships announcements for the APAC ventures highlight strong ties with healthcare providers, tech firms, and pharmaceutical giants.

- Explore the full HealthTech 250 list on Galen Growth’s website: HealthTech 250 – The Most Promising Early-Stage Digital Health Ventures of 2025.

APAC’s Digital Health Startups Are Thriving—But Can They Scale?

The Asia-Pacific (APAC) region has once again proven itself as a global hub for digital health innovation, with 31 ventures from this region featured in Galen Growth’s 2025 HealthTech 250 Early-Stage Ventures list. With nearly half of the featured startups already at Series A, the ecosystem is showing clear signs of maturing—but challenges remain. Funding bottlenecks, partnership evolution, and market scalability will be key determinants of long-term success.

A Snapshot of APAC’s Early-Stage HealthTech Ventures

This year’s cohort reflects a strong emphasis on patient-centric innovation, with Patient Solutions (23%), Research Solutions (19%), and Wellness (16%) leading the charge. These categories highlight APAC’s focus on improving healthcare accessibility, optimizing research processes, and supporting overall well-being through digital solutions.

When examining therapeutic areas, APAC healthtech startups demonstrate diversity. Mental Health continues to be a leading focus, representing 16% of the listed startups. Other major areas include Diabetes, Neurology, and Oncology, indicating a broad-based effort to tackle both chronic and acute conditions.

Several early-stage digital health ventures are securing substantial funding in these key areas. ACCELStars, a sleep-tech company developing wearable devices for sleep measurement, the only Series A funding round in the mental health segment, raising $6.95 million USD in November 2024. Meanwhile, disease-agnostic venture Kismet raised $32.5 million over two seed rounds, backed by MassMutual Ventures, Prosus Ventures, and AirTree Ventures.

Funding Maturity: Series A Dominates

Of the 31 APAC ventures listed, 45% are at Series A, suggesting an ecosystem that is steadily maturing beyond seed-stage experimentation. Some of the most significant rounds include:

- Helixon (China) – $75 M

- DeepCardio (South Korea) – $31 M

- Metagen Therapeutics (Japan) – $12 M

- Fitterfly (India) – $12 M

- Neuroglee (Singapore) – $10 M

These Series A rounds signal strong early momentum, setting the stage for future growth in APAC’s digital health ecosystem. However, securing Series A funding is only the first hurdle—sustained growth requires strong partnerships and investor confidence.

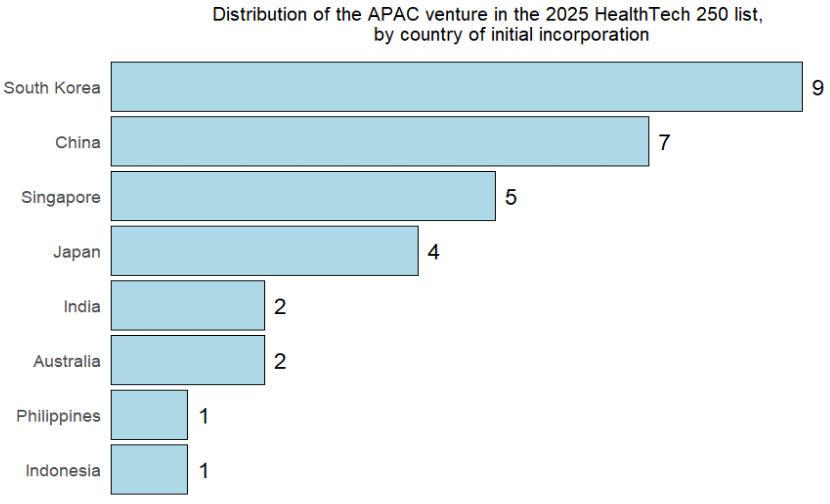

Where APAC is Leading: AI in HealthTech

APAC has cemented itself as a global leader in digital health innovation, with major hubs such as South Korea, China, Singapore, and Japan driving cutting-edge advancements. These markets are home to some of the most dynamic digital health ecosystems, fuelled by strong government initiatives, world-class research institutions, and a rapidly growing demand for tech-driven healthcare solutions.

In alignment with the rapid evolution of global digital health trends, artificial intelligence (AI) has emerged as a cornerstone of health technology innovation across the Asia-Pacific region. A significant indicator of this transformation is the fact that 20 out of the 31 APAC-based companies featured on the prestigious HealthTech 250 list are harnessing AI to power their solutions.

Some key regional players and innovations using AI:

- Silvia Health (China) specializes in AI-powered solutions for women’s health, offering personalized care and predictive analytics for better health outcomes.

- MoleculeMind (Japan) is at the forefront of AI-based drug discovery, utilizing machine learning models to accelerate the identification of novel compounds and reduce the time and cost associated with clinical trials.

- Bio Research AI (South Korea) is making significant advancements in prescriptive analytics, leveraging machine learning algorithms to analyse patient data and recommend optimized treatment strategies for chronic conditions and rare diseases.

One of the primary drivers for AI adoption in APAC is the rising demand for healthcare services, particularly due to aging populations in countries like Japan and South Korea. As these nations face increasing healthcare challenges, AI technologies offer innovative solutions for improving patient care and managing chronic diseases more effectively.

Furthermore, collaboration between tech giants and healthcare startups is fostering a dynamic ecosystem for AI-driven research and development. This synergy enables the integration of advanced technologies into clinical workflows, enhancing diagnostic accuracy, treatment planning, and drug discovery.

Partnerships: The Backbone of APAC’s HealthTech Boom

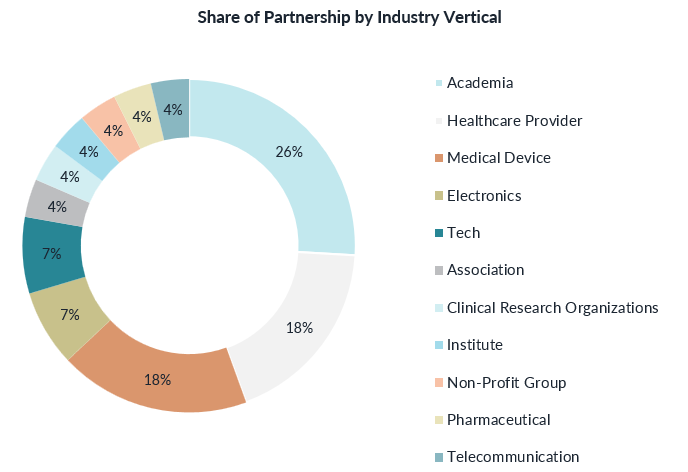

Strong partnerships are contributing to APAC’s digital health growth. In 2024, the number of partnerships in APAC doubled compared to the previous year, with academia (26%), healthcare providers (18%), and medical device companies (18%).

The strong presence of healthcare providers underscores the ongoing need for clinical validation, while academia’s increasing engagement signals a deeper focus on research-driven innovation. While corporate partnerships are flourishing, venture-to-venture collaborations remain underdeveloped compared to Europe, where startup-led deals accounted for 40% of partnerships in 2024. This signals a potential gap in early-stage ecosystem collaboration, which could limit cross-innovation and scaling opportunities. Read more in Galen Growth’s blog on Europe’s Rising Stars.

Investor Trends: Who’s Betting on APAC’s Digital Health?

Investor interest in APAC’s digital health landscape has taken on distinct trends, reflecting both regional strengths and global shifts. Local venture funds like Fireside Ventures in India and Pavilion Capital in Singapore continue to anchor early-stage funding, backing startups that are reshaping healthcare access and delivery. Meanwhile, corporate venture arms from major pharmaceutical and medical device firms are making bold moves in later-stage rounds, fuelling the expansion of healthtech players poised for regional dominance.

Despite a selective approach, international heavyweights such as SoftBank Ventures Asia and Prosus Ventures have placed strategic bets on APAC’s most promising digital health innovators in Galen Growth’s HealthTech 250 list, signalling confidence in the sector’s long-term potential. However, APAC has a lower share of Seed-stage ventures compared to North America and Europe, suggesting that very early-stage funding remains a hurdle for many startups in the region.

| VC Investors | Number of APAC-founded HT250 Ventures | Recent Investee | Value of Investment Round | Country of Venture of Incorporation |

| TIPS | 6 | GymT (Series A) | $3.1 M | South Korea |

| AirTree Ventures | 4 | Arli (Seed) | $1.9 M | Australia |

| Kakao Ventures | 3 | JNPMEDI (Pre-A) | $10.3 M | Japan |

| Goodwater Capital | 3 | Sirka (Series A) | $2.6 M | Australia |

| GL Ventures | 3 | Helixon (Series A) | 74.5 M | China |

Why This Matters: A Point of View

The insights from Galen Growth’s 2025 HealthTech 250 list serve as a critical benchmark for investors, healthcare leaders, and entrepreneurs alike. Here’s why this analysis is crucial:

- For Investors: Understanding the partnership trends and funding trajectories helps identify where to place strategic bets.

- For Startups: Insights into funding gaps and successful partnership models can guide scaling strategies.

- For Industry Stakeholders: Pharma, MedTech, and healthcare providers can identify collaboration opportunities and potential M&A targets.

Methodology: How the HealthTech 250 Was Built

Galen Growth’s HealthTech 250 leverages its proprietary HealthTech Alpha platform, analysing over 15,000 startups globally. The 2025 edition focuses on ventures:

- Founded within the past five years.

- Backed by at least one funding round (equity or grant)

- Demonstrating clear technological differentiation and commercial potential

Startups were scored across multiple dimensions, including product maturity, partnership activity, and investor confidence.

For the full methodology, refer to the full HealthTech 250 list on Galen Growth’s website: HealthTech 250 – The Most Promising Early-Stage Digital Health Ventures of 2025.

Explore the Full HealthTech 250

Discover the complete list of the top 250 early-stage HealthTech ventures shaping healthcare in 2025. Visit Galen Growth’s HealthTech 250 here.