Key Takeaways:

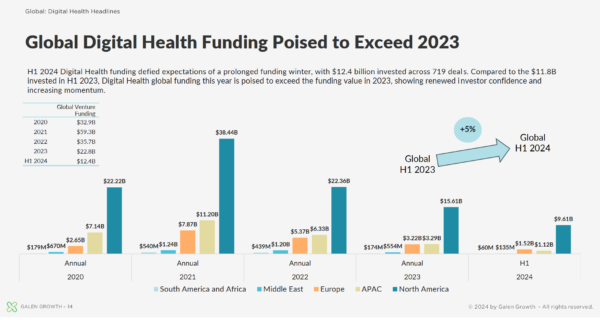

- Despite a rough 2023, Digital Health Funding rebounded in H1 2024 with a total of $12.4 billion invested.

- This resurgence indicates renewed investor confidence, particularly in AI-powered healthcare solutions.

- TechBio (digital health for biopharma research) and healthcare system partnerships emerged as key growth areas.

- The ongoing IPO drought and broader economic challenges urge cautious optimism for the later half of 2024.

- AI-focused ventures continue to attract significant investments, highlighting the technology’s role in driving the sector.

The Digital Health ecosystem has shown notable resilience and recovery in the first half of 2024, as detailed in the latest Galen Growth report. This positive performance follows a turbulent 2023, which saw significant consolidation, heightened investor scrutiny, and a notable investment retreat. Amid these challenges, health systems have honed operational efficiency, while major technology companies have strategically invested in AI, Generative AI (GenAI), and ChatGPT technologies.

Early Signs of Stabilization

The first quarter of 2024 offered a sigh of relief, halting the decline in digital health funding witnessed throughout the previous year. Q1 2024 recorded $5.3 billion across 383 deals, setting a positive tone for the rest of the year. This period was marked by mergers, strategic investment shifts, and a growing focus on integrating innovative technologies like Generative AI.

Notably, Europe emerged as a strong performer, with digital health funding rising 22% compared to the prior period. This regional performance underscores Europe’s expanding role in the global digital health landscape.

H1 2024: A Welcome Upturn

Defying expectations of a prolonged funding winter, the first half of 2024 witnessed a significant rebound in digital health funding. Investments reached $12.4 billion across 719 deals, surpassing the $11.8 billion recorded in H1 2023. This resurgence points towards renewed investor confidence and an increased momentum in the sector.

Despite broader venture capital slowdowns, digital health funding has demonstrated remarkable resilience, with the average deal size increasing 1.2 times from Q2 2023 to Q2 2024. This trend highlights the sector’s ability to attract substantial investments despite the challenging financial climate.

Emerging Trends and Key Players

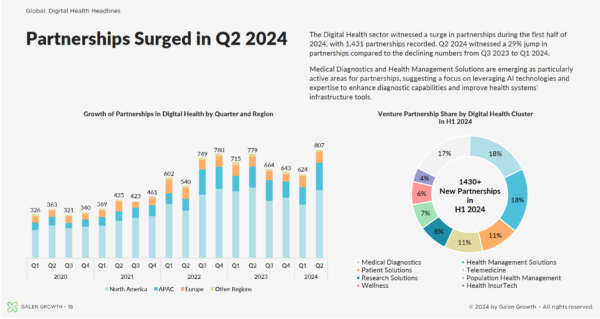

The past year has witnessed the rise of two significant trends within the digital health ecosystem: TechBio and health system partnerships.

- TechBio focuses on developing digital solutions specifically for biopharmaceutical research. This area has attracted significant investment and innovation, driven by the implementation of foundation models.

- Health system partnerships have intensified as healthcare systems grapple with pressing challenges. Collaborations with digital health ventures have doubled year-on-year, reflecting a strategic push to integrate digital solutions into traditional healthcare settings.

Dominant Clusters and AI-Driven Investments: A Closer Look

Research solutions, also known as TechBio, remained the top cluster for digital health funding in H1 2024, capturing a 20% share ($2.63 billion) with 63 deals. Following closely behind were Health Management Solutions with $1.76 billion in investments. These substantial investments highlight the surge in AI-powered research and healthcare tools.

AI-focused ventures have consistently attracted increasing investments, constituting a remarkable 57% of total funding in the first half of 2024. This is particularly significant considering only 40% of global healthcare ventures currently leverage AI technology. The utilization of Generative AI within private digital health ventures remains modest at 2%.

Investor activity has shown signs of bottoming out, yet it is premature to declare a definitive rebound. Persistent challenges such as inflation and high interest rates continue to plague venture capital, leading to a prolonged slowdown. Fundraising has been particularly hard hit, with several well-known funds failing to meet their targets and raising significantly less than in previous rounds. Despite two unicorn IPOs this quarter, exit activity has remained subdued, leaving limited partners (LPs) without significant distributions. LPs are understandably hesitant to commit more capital to venture capital in this high-interest-rate environment, leading to fundraising projections that could hit the lowest levels since 2019.

The Path Forward: Cautious Optimism

While H1 2024 has demonstrated strong performance, the ecosystem is still experiencing the aftershocks of the funding collapse in 2022 and 2023. High-profile ventures continue to shut down due to miscalculated business models, and investors are cautious. Nevertheless, venture capital inflows have regained momentum, and funding stress is gradually easing.

The ongoing IPO drought is a significant factor contributing to this cautious atmosphere. It explains why venture capitalists are coming up against a fundraising wall. The industry has collected capital commitments from limited partners globally this year on pace for a nine-year low.

Notably, the proportion of growth-stage ventures securing funding has risen by two percentage points quarter-on-quarter in North America over the past 18 months, aligning with Europe’s 42% at the end of H1. According to Galen Growth’s Alpha Forecaster, ventures with above-average signals are poised to attract strong investor interest in the second half of 2024.

Healthcare providers have emerged as primary drivers of partnerships, holding a 21% share of all collaborations. This trend underscores the growing necessity for digital solutions, particularly those leveraging AI, to enhance patient care and operational efficiency.

AI Drives Investment in Digital Health

Despite lingering uncertainty, the digital health innovation ecosystem shows signs of progress. Renewed investor confidence and a stabilizing investment landscape suggest continued growth for the sector. However, established players like big pharma and health systems might struggle to adapt quickly due to internal constraints.

In contrast, startups and funds focused on AI have emerged as a bright spot. By aligning with the market’s enthusiasm for AI, they’ve navigated broader VC concerns. The fear of missing out on this transformative technology has driven investor interest, translating to high valuations, larger deals, and the rise of dedicated AI-focused funds. This trend solidifies AI’s crucial role in propelling investment within the digital health sector and beyond.

While global digital health funding is likely to surpass 2023, consolidation is expected to continue as the ecosystem navigates its complexities. Nevertheless, the resilience and recovery witnessed in H1 2024 provide a solid foundation for exciting future developments in this dynamic field.

A Call to Action: The Galen Growth Report

For a deeper dive into digital health funding trends, the bi-annual Galen Growth report is an invaluable resource. This comprehensive report, powered by HealthTech Alpha, the #1 resource for Digital Health data, intel, and insights, offers over 80 pages of insightful data and analysis on the latest trends, investment patterns, and technological advancements shaping the global digital health landscape.

About Galen Growth

Galen Growth is a pioneering global think tank advancing Digital Health innovation. With approximately a decade of unparalleled expertise, we consistently deliver cutting-edge research, analytics, and insights to industry leaders and investors. Our commitment to excellence has solidified our reputation as the premier authority in this dynamic field. With a global reach that includes offices in the USA, Europe, and Asia, Galen Growth is uniquely positioned to provide comprehensive and strategic support to the evolving Digital Health ecosystem.