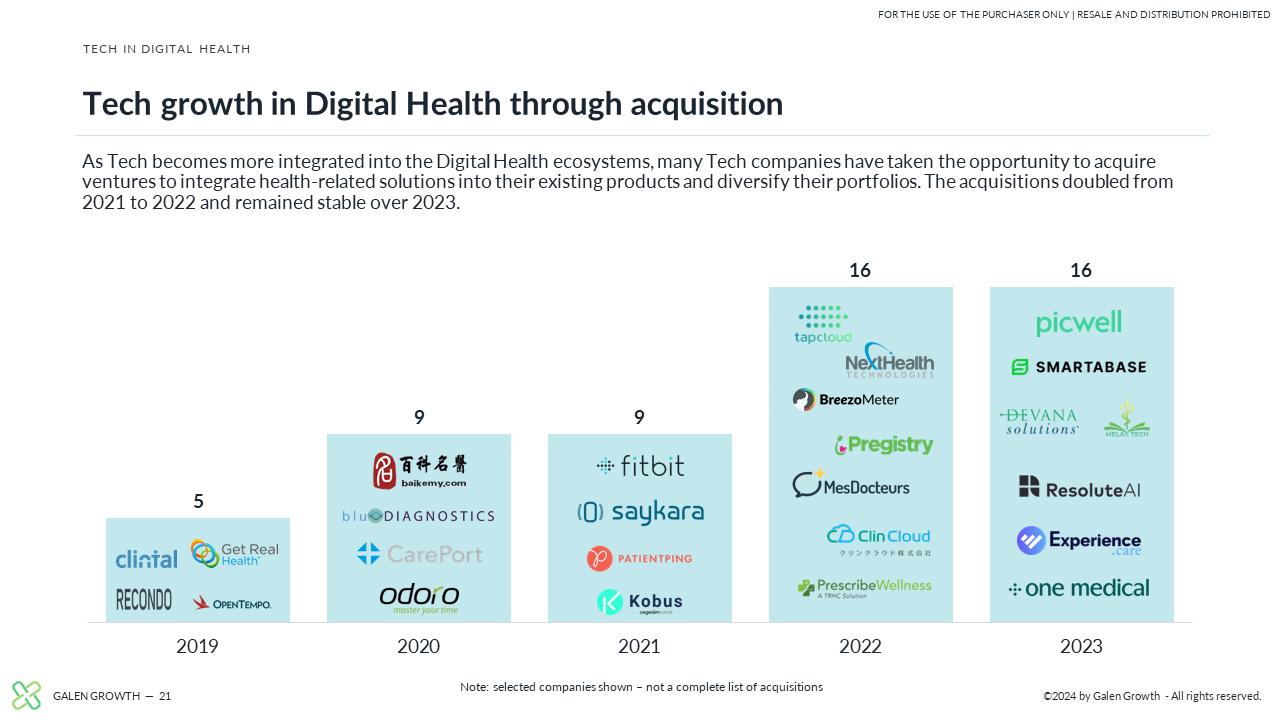

The Digital Health revolution is steadily gaining momentum, driven by innovations in data analytics, AI/ML models, and cloud computing. Galen Growth’s comprehensive report dives into the intersection between Big Tech and Digital Health globally, highlighting how partnerships and investments by leading tech companies are set to transform the ecosystem.

While Big Tech’s role in Digital Health innovation is complementary, their substantial resources and technological prowess are crucial in forging impactful partnerships. These collaborations leverage tech capabilities to enhance healthcare delivery, albeit with careful consideration of patient-centric values and regulatory requirements. Startups, academic institutions, and healthcare organizations remain at the forefront, driving the unique advancements needed in this specialized field.

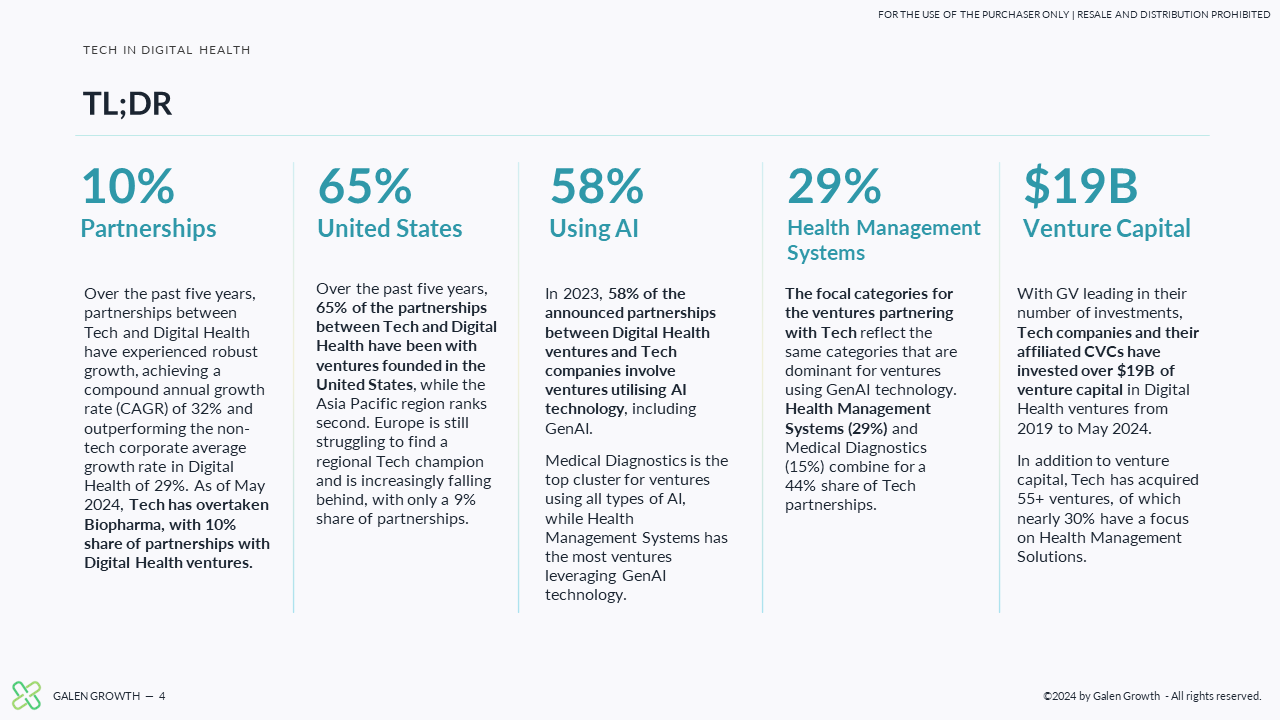

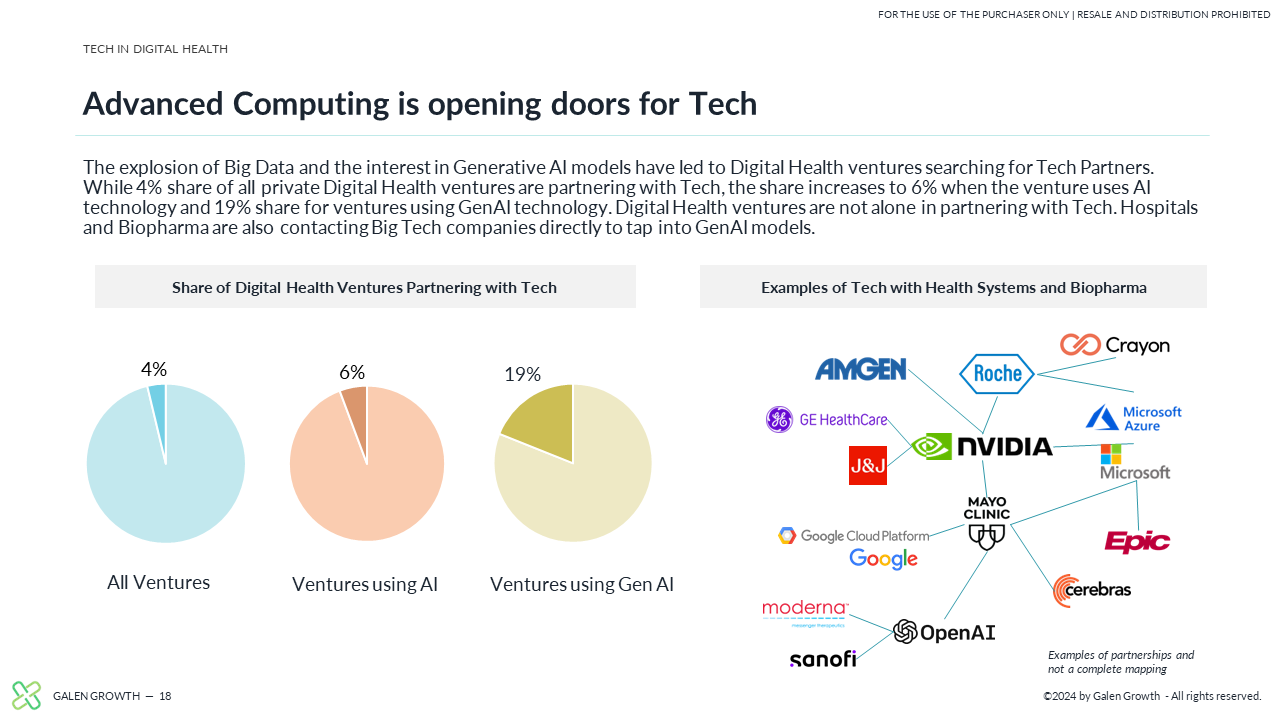

Key insights from Galen Growth’s report illustrate significant trends and developments. Over the past five years, partnerships between tech companies and Digital Health ventures have grown at an impressive CAGR of 32%, surpassing the 29% growth rate of non-tech corporate collaborations. As of May 2024, Tech has overtaken Biopharma, claiming a 10% share of partnerships with Digital Health initiatives.

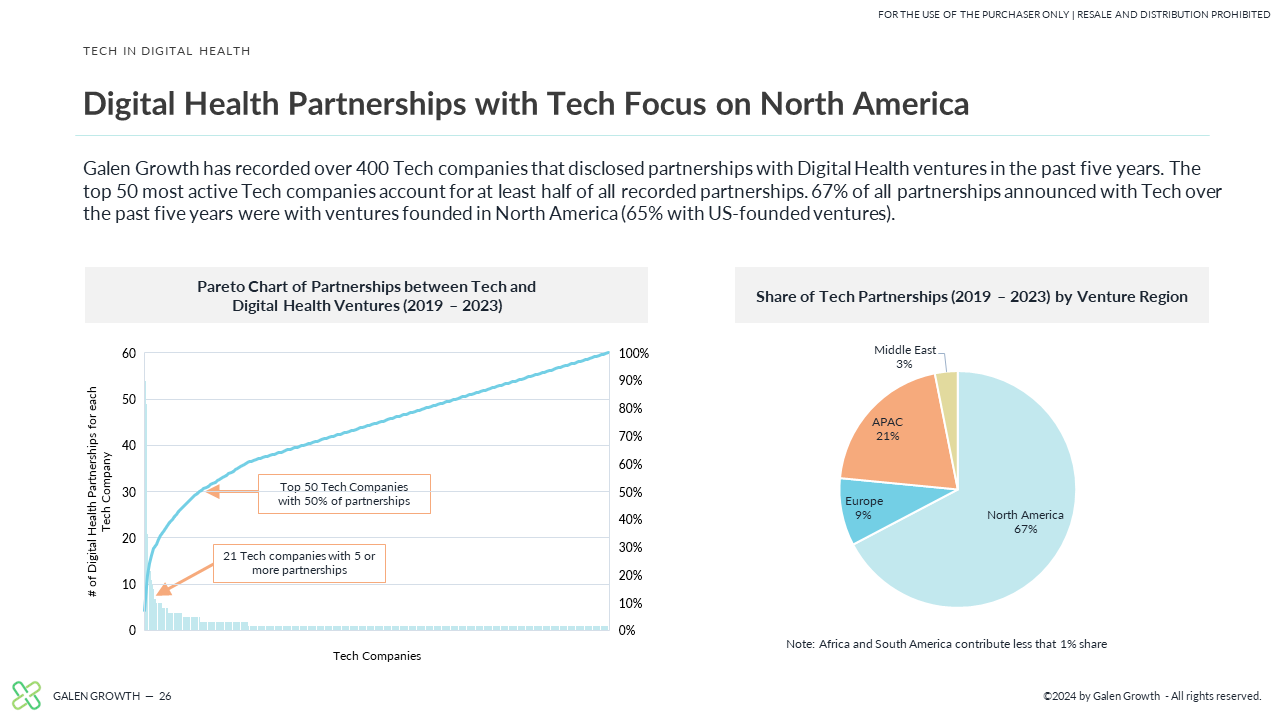

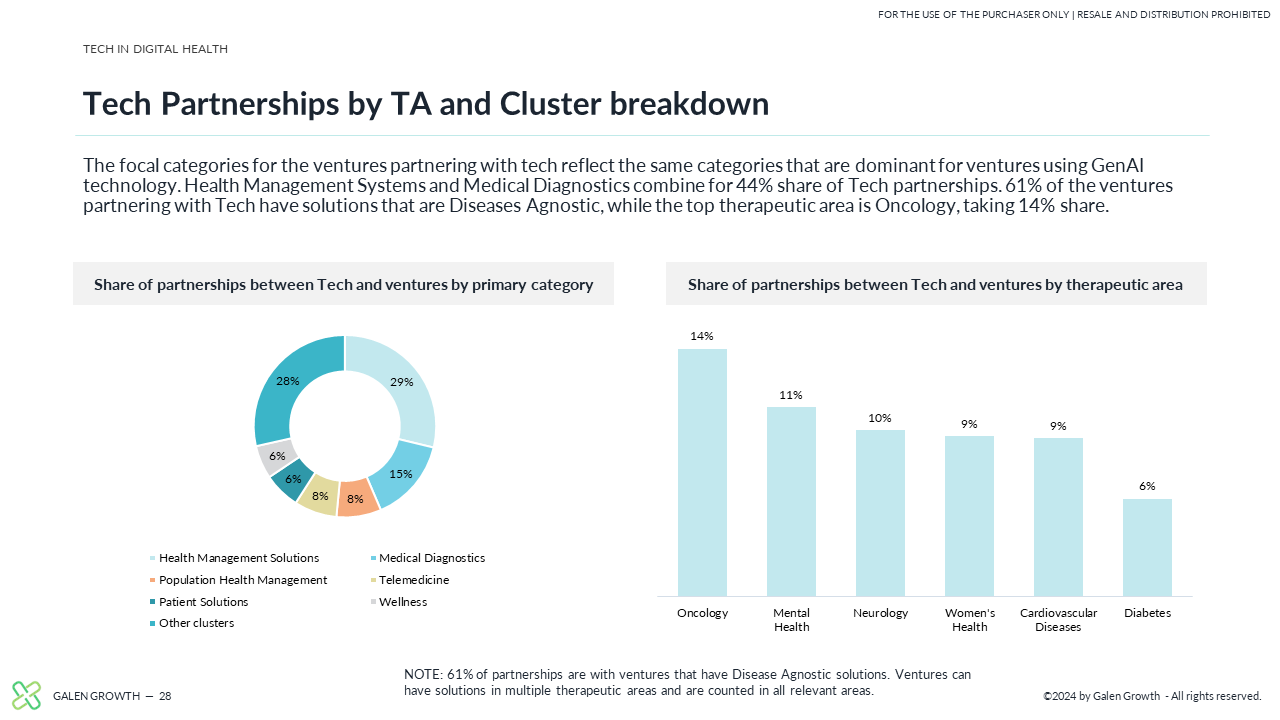

The United States leads with 65% of these partnerships, followed by the Asia Pacific region. In contrast, Europe faces challenges, holding only a 9% share and struggling to identify a regional tech leader. AI technology plays a pivotal role, featuring in 58% of the partnerships announced in 2023. Health Management Systems (29%) and Medical Diagnostics (15%) emerge as key areas of focus.

Investment trends reveal that GV (formerly Google Ventures) is at the forefront, with tech companies and their Corporate Venture Capital arms investing over $19 billion in Digital Health ventures from 2019 to May 2024. This substantial investment underscores Big Tech’s growing influence and the potential for transformative change in the Digital Health sector.

Key insights of the report:

1. Partnership Growth

Tech and Digital Health partnerships have grown at a CAGR of 32% over the past five years, surpassing the 29% growth rate of non-tech corporate partnerships.

2. Regional Dynamics

- United States: Dominates with 65% of partnerships.

- Asia Pacific: The second most active region.

- Europe: Holds a 9% share, struggling to find a regional tech champion.

3. Technology Trends

AI technology is central, involved in 58% of 2023 partnerships.

4. Venture Categories

Health Management Systems (29%) and Medical Diagnostics (15%) are primary focus areas. These align with the dominant categories for ventures using GenAI technology.

5. Investment Landscape

GV (formerly Google Ventures) leads the way in terms of the number of investments. Tech companies and their affiliated Corporate Venture Capital (CVC) arms have collectively invested over $19 billion in Digital Health ventures from 2019 to May 2024.

Featured companies in the report Is Big Tech Important to Digital Health Innovation?

- Digital Health ventures featured in this report: MIDI Health, CMR Surgical, TuMeke, AliveCor, Scietrain (西湖心辰), Relation Therapeutics, Generate Biomedicines, Ibex Medical Analytics, Quell, Paradigm, Genesis Therapeutics, Weimai (微脉), Delve Bio, Holmusk, Signos, Owlet, Rad AI, Sesame, Habit Factory, Andor Health, Dyno Therapeutics, Vim, ai

HealthTech Alpha, a Galen Growth proprietary solution, and the global leading Digital Health private market data, intel and insights platform powers this report!

Explore our latest Digital Health reports

About our Premium Reports

Our Premium Reports are specialized reports that are only available to active users with HealthTech Alpha Pro and HealthTech Alpha Enterprise accounts and are provided at no additional cost.

Source of Data

Galen Growth’s proprietary platform, HealthTech Alpha, provides the data source for this report. Corporate Business Development, Business Intelligence, and Digital Health Partnership teams worldwide prefer HealthTech Alpha, the world’s most-trusted Digital Health data, intel, and insights platform. Visit https://www.healthtechalpha.com to learn more about our data or https://www.galengrowth.com research for our reports.

Our Mission

Founded in 2016 by Digital Health experts, Galen Growth empowers global Fortune 500 companies, institutional investors, and promising Digital Health ventures to fast track their digital health strategy to create significant financial and social values. To find out more, visit https://www.galengrowth.com

| ABOUT GALEN GROWTH | |

| TECH’S ENTRY INTO DIGITAL HEALTH | 10 pages, 10 charts |

| TECH PARTNERSHIP INSIGHTS & TRENDS | 7 pages, 8 charts, 3 tables |

| TECH INVESTMENT INSIGHTS | 6 pages, 4 charts, 4 tables |

| BIG TECH PORTFOLIO & INVESTMENT MAPS | 12 pages, 9 charts, 3 tables |

| KEY INFORMATION |

BASIC

-

Purchase and download this report

-

Access to limited data in HealthTech Alpha

PRO

-

Sign up now to download all premium research

-

Access and download all data in HealthTech Alpha

Enterprise

-

Get full access to unmatched premium research for your organization

-

Additional collaboration features to take your team's research and collaboration to the next level