United Kingdom Digital Health:

As 2024 unfolded, Galen Growth presented its annual edition and comprehensive analysis of the European Digital Health landscape for the previous 12 months. Among the myriad revelations, one resounding truth emerged – the United Kingdom (UK) is the unrivalled leader, clinching the top spot as the #1 Digital Health ecosystem in total funding invested throughout 2023.

The UK’s Healthcare Canvas:

With a population of 67 million and healthcare expenditure of 11.3% of GDP, the United Kingdom is a steadfast guardian of public health. Notably, 18.6% of its populace is 65 or above, underscoring the imperative for innovative healthcare solutions tailored to an ageing demographic. The cornerstone of the UK’s healthcare provision is the revered National Health Service (NHS), funded through general taxation and heralded for free healthcare at the point of need.

A Thriving Digital Health Ecosystem:

The UK has a vibrant Digital Health ecosystem, boasting 855 ventures founded since 2012. This staggering figure underscores the nation’s allure as a fertile ground for innovation and entrepreneurship.

Unveiling the Executive Briefing:

Today, we venture deeper, unveiling a bespoke Executive Briefing meticulously crafted to offer Digital Health leaders a nuanced understanding of the UK’s Digital Health landscape. This article serves as a succinct summary of our analysis, spotlighting investment trends, exits, Digital Health category focus, disease concentration, and investor activity.

Investment Trends:

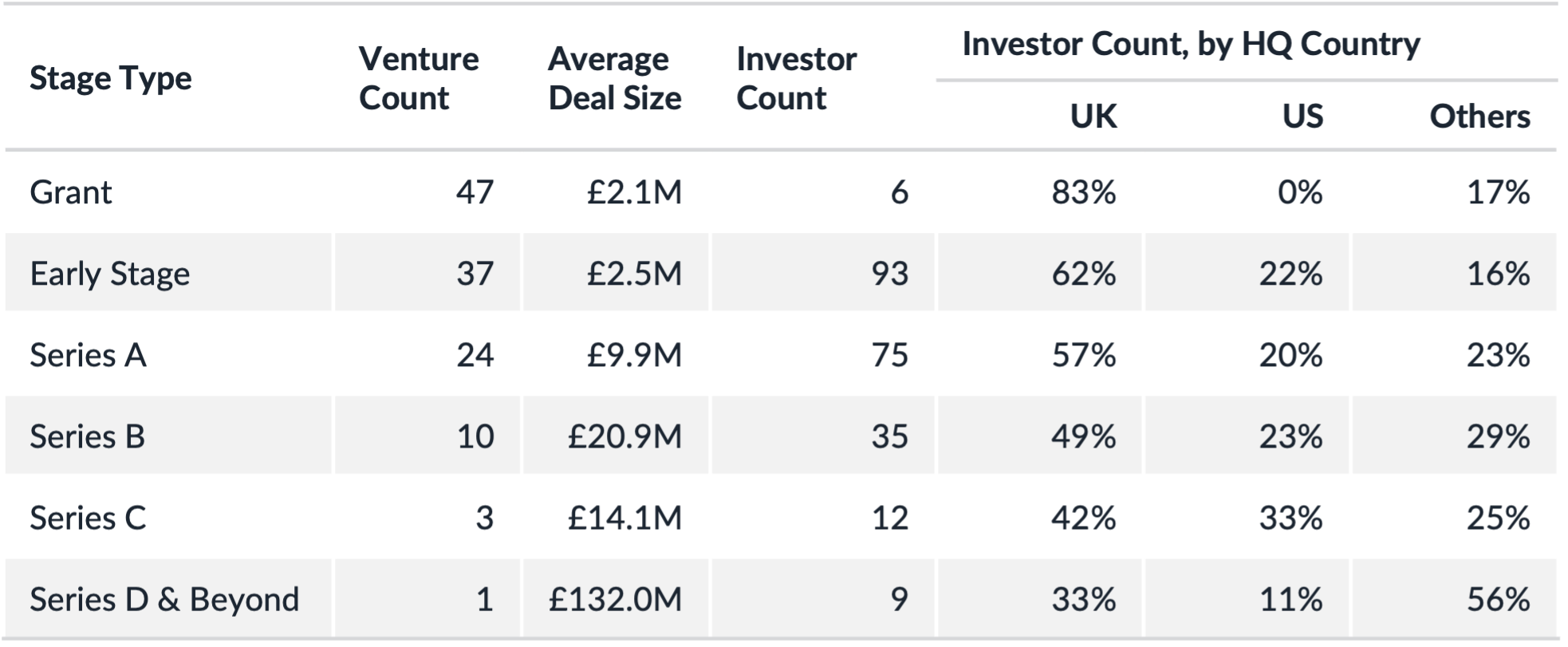

In 2023, ventures within the UK secured £835 million ($1.1B) across 138 deals. Though this marked a -34% and -32% decrease in total investment and deal volume, respectively, compared to 2022, the UK retained its status as a magnet for Digital Health investment. Most noteworthy is Series A and Series B rounds accounted for 28% and 25% of total investment, respectively.

Peaks and Troughs:

Peaks and troughs have punctuated the investment journey within the UK Digital Health ecosystem. Notable peaks include Q3 of 2019 and Q2 of 2021, each witnessing monumental surges in investment. However, Q4 of 2023 saw a stark downturn, with a mere £61.5 million ($78M) deployed across 15 deals, marking the lowest deal volume in half a decade.

Read our ongoing series on Digital Health Core Investors to understand which investors have persistently and repeatedly bucked the trend and invested, come rain or shine, in the United Kingdom.

Category Focus and Disease Concentration:

In 2023, Health Management Solutions emerged as the highest-funded cluster, with a staggering £190.2 million ($241.6M) invested, a commendable rise by six spots from 7th place in 2022. Medical Diagnostics followed closely as the second highest-funded cluster, securing £125 million ($158.8M) in investments. Meanwhile, Research Solutions (a.k.a. Pharma Tech), which had occupied the top spot in 2022, trailed closely in 3rd place with £123.8 million ($157.3M) invested. Additionally, Remote Devices catapulted from 11th place in 2022 to #5 in 2023, contributing to the top 5 clusters comprising 70% of total investment value in 2023.

Therapeutic Areas:

Focusing on therapeutic areas, Oncology emerged as the highest-funded, securing a substantial £153.1 million ($194.5M) in investments. Mental Health ascended by three spots to secure 2nd place in 2023, attracting £87.5 million ($111.2M). Meanwhile, Women’s Health retained 3rd place with £66.2 million ($84.1M) invested. Notably, Hepatology and Dermatology broke into the top 5 highest-funded therapeutic areas, surpassing Neurology and Geriatrics, which previously held positions within the top 5 in 2022.

The NHS: A Vanguard in Collaboration:

The NHS emerges as the most active partner in Digital Health, boasting 88 disclosed partnerships with Digital Health ventures since 2012. Of these, 75% were founded in Europe, with the lion’s share in the United Kingdom.

The top 10 at Series A Digital Health venture NHS partner to watch, ranked by Alpha Score ™ or venture maturity, include:

| Company Name | Category |

| Cyted | Prescriptive Analytics |

| Phlo | Consumer Marketplace |

| Second Nature | Wellness Apps |

| Limbic | Digital Therapeutics |

| Medefer | Hospital Solutions |

| Healthera | Physician / Clinic |

| Locum’s Nest | HCP Job Boards |

| Everylife Technologies | Home Healthcare |

| uMed | Decentralized Clinical Trials |

| Optellum | Diagnosis Tools |

This collaborative ethos underscores the synergy between public healthcare provision and private innovation, propelling progress.

Harnessing the Power of Data Insights:

This insightful Executive Briefing derives its value from robust data sourced from HealthTech Alpha, the global leading Digital Health data, intel, and insights platform.

Accessing the United Kingdom Digital Health Report:

For those eager to delve deeper into the intricacies of the United Kingdom Digital Health ecosystem, a complimentary download of the Executive Briefing awaits on our Galen Growth research page. Embark on a journey of enlightenment, armed with insights poised to redefine the landscape of Digital Health innovation.